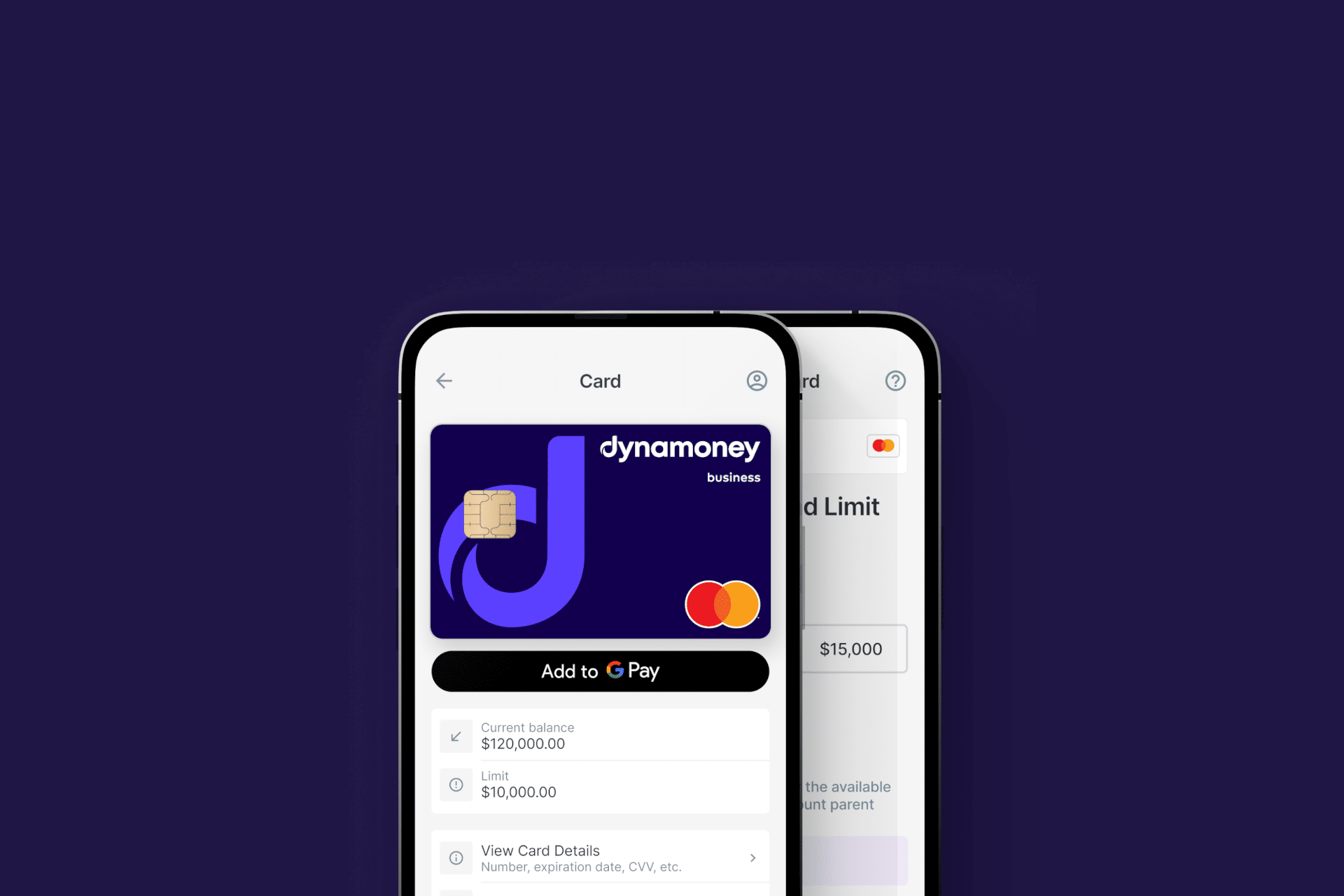

A card that suits all your business needs

Our easy to use overdraft account with a credit card attached, offers you flexibility and simplicity when it comes to managing your business expenses. With a Dynamoney credit card use your overdraft funds from and receive access to a range of features and benefits, carefully curated to support your needs.

- Multiple cards under one limit

- Different levels of access

- Set monthly spending limits

Enjoy access to a wide range of features and benefits1

Thanks to our friends at MasterCard2 , we are excited to offer you some extra support:

Extended Warranty

Additional cover for the repair or replacement of a covered purchase that has ceased to operate and requires repairs upon expiration of the original warranty.

E-Commerce Protection

The reassurance of knowing that you’re protected if an item you buy doesn’t arrive or isn’t what you thought it would be.

Travel Inconvenience3

Travel with peace of mind knowing that your trip will be re-imbursed, up to the policy limit, in the event of a trip cancellation, curtailment, delay or missed connection.

Mobile Phone Protection

Feel protected with extra insurance cover against theft and accidental damage for your eligible mobile device.

Download our app

Our mobile app is easy and simple to use. Download the Dynamoney App onto your Android device through Google PlayTM or onto your iPhone through the App Store.

Simply use the camera on your smart phone and scan the appropriate QR code to download or click the links below:

For more information about Google Play please click here.

1. Please note these additional features are only available to the eligible cardholder. For travel inconvenience cover the entire cost of your flights must be charged to your credit-card. Please refer to the terms and conditions as to the meaning of eligible cardholder.

2. Cover is subject to terms, conditions and eligibility requirements. These additional features are insurance products which are provided by AIG Australia Limited ABN 93 004 727 753, AFSL 381686 (AIG) and Mastercard. Mastercard acts as a Group Purchasing body under ASIC Corporations (Group Purchasing Bodies) Instrument 2018/751 in arranging this insurance. You should consider the policy wording in deciding whether the insurance is suitable for you. Please also see the terms and conditions as to the meaning of eligible cardholder

3. Travel inconvenience benefits refer to cancellation, rescheduling, interruption or curtailment, delay and missed connection. You may refer to the terms and conditions for more details.